Business Central: Leveraging the Cost Shares Action for Better Item Management

Cost transparency and accurate pricing decisions are fundamental to profitable business operations. Microsoft Dynamics 365 Business Central’s Cost Shares action provides powerful insights into item cost structures, enabling businesses to make informed decisions about pricing, profitability, and cost management.

What the Cost Shares report does

The Cost Shares action is a powerful analytical tool accessible from both the Item Card and Item List. The Cost Shares report in Business Central is designed to give manufacturers clear visibility of the true cost structure of a product. Instead of only seeing a single “unit cost,” the report breaks that figure down into the specific materials, sub-assemblies, labor, and overhead that make up the final total.

For finance professionals, this means transparency into cost drivers and a reliable basis for decisions about pricing, profitability, and vendor negotiations. For operations teams, it provides a way to validate efficiency, spot cost anomalies, and improve margins. In short, Cost Shares turns cost accounting from a black box into a clear, actionable view.

Key benefits of using Cost Shares

- Cost transparency

Instead of a single lump sum, you can see exactly how much of the product cost comes from materials, sub-assemblies, machine time, or labor. This helps finance leaders understand what’s really driving product costs. - Data-driven pricing decisions

By knowing the rolled-up cost of an item, you can set sales prices with confidence. For example, if a product’s cost is $171.70 and your margin target is 45%, you can calculate a target price of about $312 and validate it against market rates. - Profitability analysis

Finance leaders can compare actual margins across different product lines, identify which products are underperforming, and prioritize improvement efforts. - Cost control and optimization

Detailed breakdowns highlight which sub-assemblies or operations consume the most resources. This visibility makes it easier to focus on operational efficiency or supplier negotiations to identify where improvements will have the greatest impact. - Better supplier discussions

When procurement teams can show a vendor exactly how their component contributes to overall cost, they enter negotiations with facts rather than estimates.

How Cost Shares works in practice

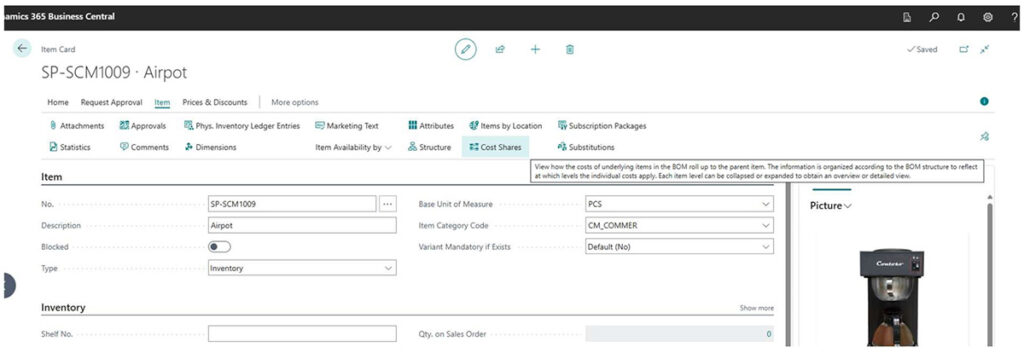

Let’s look at an example from the CRONUS demo company, using the item “Airpot” (Item SP-SCM1009):

- Navigation: Open the Item Card and select Item > Cost Shares.

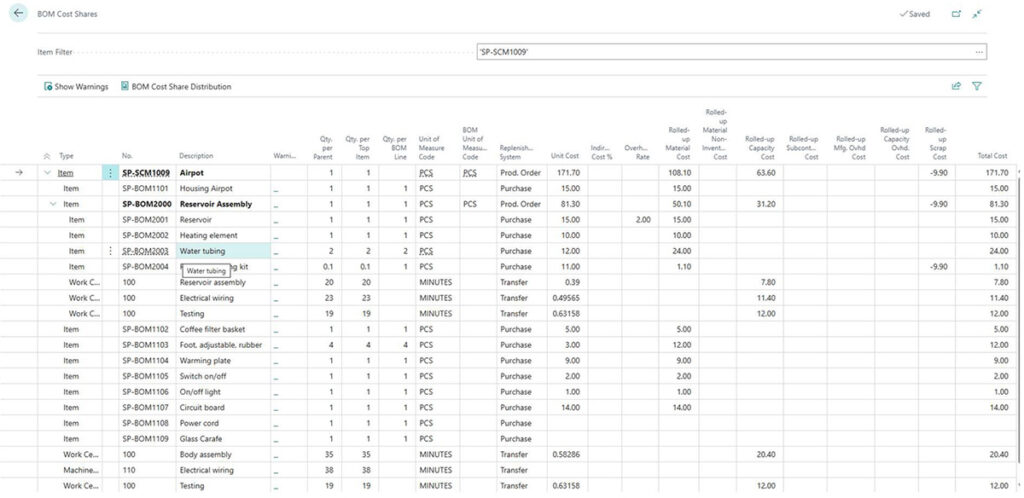

- Breakdown: The report shows:

- Material costs – purchased components and sub-assemblies, rolled up automatically.

- Capacity costs – labor and machine time drawn from routing data.

- Total cost – the full manufacturing cost, including all components and operations.

- Component detail – line-by-line costs for each item and operation.

For the Airpot (Item SP-SCM1009 from the CRONUS demo database), the total rolled-up cost was $171.70, with nearly half of that coming from the reservoir assembly alone ($81.30). Operations such as wiring and testing accounted for an additional $40+ in labor costs.

Why this matters for manufacturers

The Cost Shares report provides essential information for finance and operational leadership for tracking item costs and targeting manufacturing processes for optimization.

For finance professionals, this level of detail supports:

- Strategic pricing – Align target margins with actual cost data.

- Make vs. buy decisions – Decide whether to outsource sub-assemblies or keep them in-house.

- Forecasting and budgeting – Improve the accuracy of financial projections by basing them on real rolled-up costs.

For manufacturing leadership, Cost Shares is equally valuable:

- Operational efficiency – Highlight which processes consume the most time and cost.

- Continuous improvement – Identify opportunities for process automation or vendor changes.

- Alignment with finance – Ensure that operational decisions translate into measurable financial impact.

Implementing Cost Shares effectively

Businesses interested in implementing Cost Shares can benefit from the following recommended procedure:

- Assess and plan – Review current costing methods and identify gaps in visibility.

- Configure and set up – Select the appropriate costing method, set up indirect costs, and integrate with related Business Central modules.

- Test and validate – Run scenarios with known data to confirm accuracy.

- Train and roll out – Provide finance and operations teams with training and supporting documentation.

Common issues and troubleshooting

Below are some of the common issues that occur and initial steps you can try to troubleshoot them.

- Incorrect costs showing – Validate your overhead allocation methods and indirect cost percentages.

- Missing data – Ensure costing methods and item ledger entries are complete.

- Unexpected calculation results – Check units of measure, rounding rules, and posting setup.

Looking ahead

The Cost Shares report already delivers powerful insights, but manufacturers can enhance it further with:

- Activity-based costing – Provides more precise overhead allocation for deeper profitability analysis.

- Real-time cost updates – Offers dynamic adjustments based on market conditions, helping drive proactive pricing.

Get started with Cost Shares

The Cost Shares report in Business Central is more than a costing tool—it’s a strategic decision-making resource. By understanding exactly where costs come from, manufacturers can make smarter pricing, production, and supplier decisions that drive profitability and long-term growth.

For help tailoring Cost Shares analysis to your business, contact ArcherPoint by Cherry Bekaert to learn more about improving your cost and pricing strategies with Business Central.

Trending Posts

Stay Informed

Choose Your Preferences

"*required" indicates required fields