How to Fine-Tune and Present Cash Flow Data in NAV 2013 R2

Several weeks ago, a very well written blog was posted on how to create a cash flow schedule in NAV 2013 R2. In this blog, I wish to expand on how the data can be fine-tuned and then the many ways in which this information can be presented to decision makers.

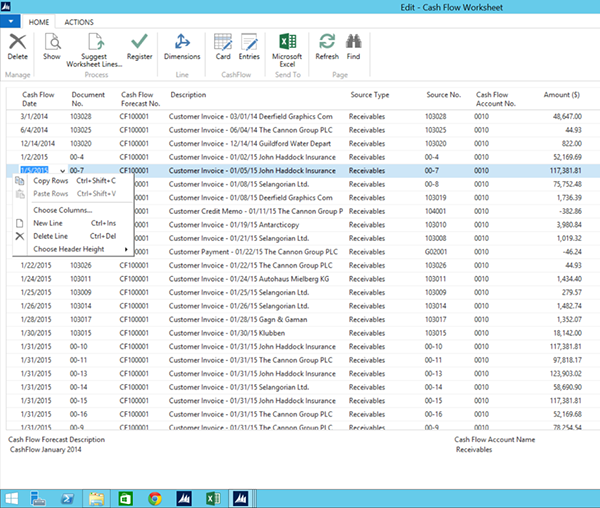

After you have selected the options you want to include in the cash flow statement, the entries are then suggested. At this time, you can alter the information prior to registering the entries. For example; you have just gotten off the phone with one of your customers. He has informed you that the large invoice he has with you cannot be paid within the agreed upon time. After negotiating, you have decided to allow an additional two weeks, or the payment will be paid over multiple periods. You have the option of modifying the entries without altering the actual receivable. Here you can change the due date, add additional lines, and spread the payments over the agreed upon timeframes.

All of these changes can be made prior to the registration of the entries. And again, this does not affect the original entries so that the aging reports will reflect the original terms and due dates.

This is true of all entries suggested in cash flow. They can be added, deleted, or modified to best represent the true cash impact.

Figure 1 – Cash Flow Worksheet lines and how they can be modified.

Now that the cash flow has been created, there are many ways in which this information can be viewed.

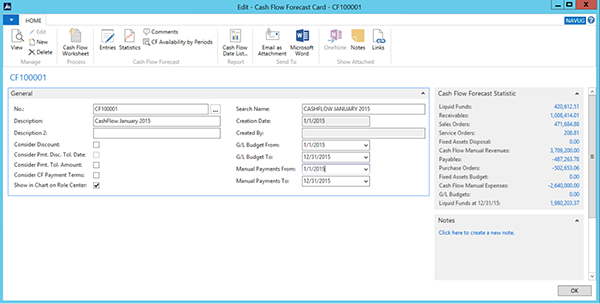

The cash flow card itself has a fact box with all pertinent categories listing the cash inflow or outflow.

Figure 2 – Cash Flow Forecast card with fact box.

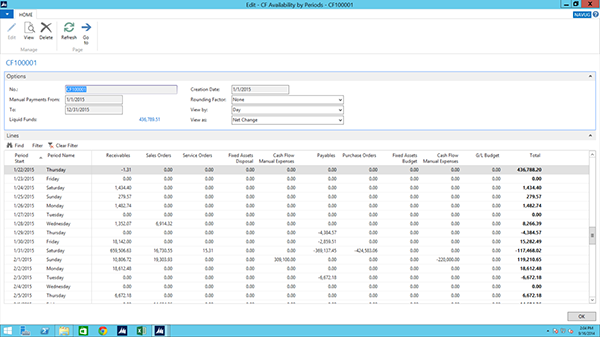

There is also a CF Availability by period view. This view allows you to use an option field to view the in/out flows by day, week, month, quarter, and year or accounting period. And, of course, the columns of information can be shown or hidden and in any order.

Another option allows you to view the information as a net change or a running balance

Figure 3 – Cash Flow Availability view by Periods.

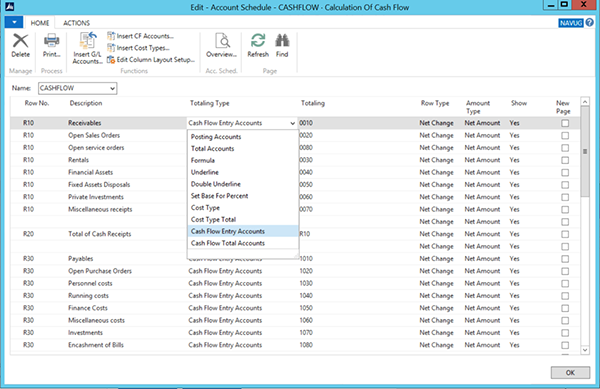

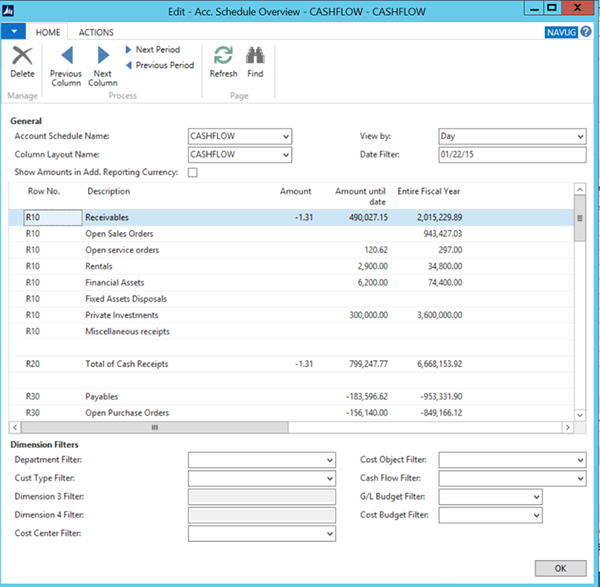

Since the cash flow entities have their own chart of accounts, these can be used to create additional financial reports using account schedules. Note how the choices to select the type of account now include cash flow accounts. The account schedules are created in the same manner that previous accounts schedules were created. These reports can be viewed or run just as any other account schedules are generated.

Figure 4 – Creating an Account Schedule with Cash Flow COA.

Figure 5 – Cash Flow Account Schedule Overview.

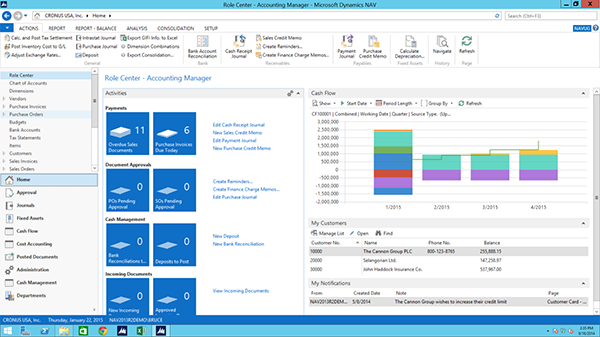

And of course, with the graphic capabilities of NAV 2013 R2, the information can be viewed as a graph on the role center. And the graph allows drill down capabilities to get to the details of the information presented.

Figure 6 – Role Center with Cash Flow in Graphic Mode.

The cash flow functionality of NAV 2013 R2 allows a company to generate any and all data points that affect the cash position and to manipulate the data to best depict what is happening at any given time.