How to Leverage Financial Reports in Business Central for Enhanced Business Insights

Financial reporting is essential to stay in touch with the vital signs of your business.

Accurate financial reports reveal the true state of your business assets, liabilities, income, and expenses — where your money comes from, where it’s going, and how much you have.

This information is valuable for setting and achieving Key Performance Indicator (KPI) targets. It’s also crucial for diagnosing and correcting problems in your business. Plus, a faithful record of your financials helps you to comply with tax, market, and lending regulations.

Microsoft Dynamics 365 Business Central is a powerful tool that helps businesses like yours manage financial reports, inventory records, and budgets. It’s a cloud-based Enterprise Resource Planning (ERP) software solution with Customer Relationship Management (CRM) features. Business Central has replaced Microsoft’s legacy Dynamics NAV software.

Leveraging Business Central’s financial reporting capabilities is an excellent way to gain enhanced insight into your business operations.

Ready-to-Use Reports in Business Central

Business Central comes with many standard financial reports that cover the needs of most businesses — built-in and ready to populate. It calls these “default reports.” The following are the three most popular default financial reports in Business Central:

Income Statement

An income statement tells you how profitable your business is by categorizing and adding up transactions from the last year. Some companies also use quarterly or even monthly income statements.

It contains:

- Where your revenue came from (for example, sales)

- Where your expenditures went (for example, wages, utilities, etc.)

- The figures for each category of revenue and expense

- The total revenue and total expense

- A total net profit or loss derived from the information above

An income statement can help you set and track KPIs related to these and other areas:

- Gross profit margin: How much revenue is your business generating relative to the cost of sales?

- Net profit margin: How much revenue is your business generating relative to all its operating expenses?

- Return on investment: How profitable is your spending? Are you investing in the right places that make your business the most money over time?

Balance Sheet

A balance sheet describes your business’s financial position regarding assets, liabilities, and equity. It tells you what your company has, what it owes, and what it’s worth. It will record:

- Current assets: Assets that will or could turn into cash value within a year, such as inventory and investments. The balance sheet notes the value of each asset type and the total value of current assets.

- Long-term assets: Assets your business owns that are not intended to be liquidated within a year, like land, buildings, and equipment. The sheet notes the value of each asset type and the total value of long-term assets.

- Other assets: The value of your business’s intangible assets, such as intellectual property and brand goodwill.

- Total assets: The full value of all the assets mentioned above.

- Current liabilities: Debts that need to be paid within a year, including the amount of each debt category and the total value of current liabilities.

- Long-term liabilities: Debts your business owes that are not due within a year. The total long-term debt will be recorded.

- Owner’s equity: Also called shareholders’ equity in publicly traded companies. This is the company’s total value that would be payable to its owners if it were to be liquidated. Its components include paid-in capital, retained earnings, and other forms of equity.

Since a liquidated company would need to pay its liabilities before returning the balance of its wealth to owners, an accurate balance sheet will always show that owner’s equity equals total assets minus total liabilities. It represents a balance between total assets on one side and total liabilities plus total equity on the other side.

A balance sheet generated by Business Central can provide strategic insights about your business. For example:

- You can check your liquidity ratio. To calculate this ratio, divide current assets by current liabilities. If assets are equal to twice or more the value of liabilities, you are in a solid position to invest in expanding your business. You have room to take on more debt as you scale.

- If current liabilities exceed current assets, your business may need to concentrate on generating more cash to meet upcoming financial obligations and avoid incurring further short-term debts over the medium term.

Cash Flow Statement

Like an income statement, a cash flow statement provides information about money entering and leaving your business. However, the two have different purposes:

- The income statement summarizes all your business’s revenue and expenses, as well as factors like depreciation, to arrive at a net income figure reflecting profitability over a given period.

- The cash flow statement provides a detailed picture of all the actual cash flowing in and out of your business at a given time. It starts from the net income and totals all the cash transactions that add to or subtract from the business’s total cash.

Reporting on cash flow depends on the revenue and expense information from the income statement. It also relies on information about debts and investments from the balance sheet. Therefore, it can only be completed after the other two reports.

A cash flow statement provides an accurate picture of the movement of money that your business is earning and spending at a given time. Where an income statement tells you about your business’s profitability, a cash flow statement tells you about its ability to access cash at a given moment to meet its financial obligations.

You can derive actionable insights from your cash flow statement. For instance, you can:

- See whether your business has cash to meet pressing commitments like monthly bills.

- Compare trends in different sources of cash flow over time. For example, a cash flow statement can help you diagnose declining sales of a particular offering, even if the overall profitability of your business is increasing. This information allows you to address problem areas and maximize earnings.

- Realign budgets and spending. Your cash flow statement will expose areas where your business is exceeding its budget so you can correct budgets or reduce expenses as needed.

Custom Financial Reports in Business Central

In addition to the default reports in Business Central, the software enables you to customize your financial reports to suit your purposes.

Some businesses need to track their financial accounts in finer detail than the categories the default reports allow. For example, many companies have regular or retained clients and need to access records of revenue and expenses within each client account. This information equips you to monitor every client account’s status and grow each customer relationship to its full potential.

Create New Custom Financial Reports

You can create your custom financial reports in Business Central to address these and other needs by following these steps:

- Open the financial reports section in Business Central.

- Create a new report and define the rows.

- Insert individual accounts from your General Ledger rather than account categories, or create the subcategories that suit your needs.

This approach allows you to create a report that’s as granular as you need, down to recording every transaction from an account.

Customize Existing Financial Reports

Alternatively, you can customize an existing report in Business Central. This is an efficient choice when one of the default reports, such as an income statement, aligns with what you need, but you are looking for additional detail. To modify an existing report:

- Choose the default report that most closely matches your requirements.

- Edit the rows to replace or add categories with the level of specificity you need.

- Modify columns and formatting to present the information in the way most useful to you.

Custom reports allow you to define, track, and compare the items that matter most for your KPIs.

Report Automation in Business Central

Financial reports need to be updated and delivered at regular intervals. Depending on the report, you may need to populate it and distribute it annually, quarterly, or monthly. Given that requirement, generating and publishing financial reports is an ideal process for scheduling and automation. Business Central makes this possible.

Automating and scheduling your financial reports through Business Central has several benefits. You can:

- Streamline your financial reporting operations.

- Save time, effort, and money that would otherwise be invested in manual reporting.

- Secure report accuracy by minimizing the risk of human error.

- Access up-to-date information about your business finances whenever you need it.

- Ensure that external and internal stakeholders can readily access the information they need.

- Empower strategic business moves with accurate, accessible, and timely financial insights.

How to Automate Reporting

You can automate recurring report generation in Microsoft Business Central by following these steps:

- On the financial reports page, select “Print.”

- Set the report you want to generate and select “Send to.”

- Choose the “Schedule” action.

- Populate the fields to generate a recurring report at set intervals. You can set the Earliest Start Date/Time for the beginning of the period to be captured, the Expiration Date/Time for the end of the period, and the Next Run Date Formula to determine how regularly a new report should be generated. You can set reports to be daily, weekly, monthly, quarterly, annually, or any other frequency you choose.

- Click “Set Status to Ready.” The report will be automated to start running at the scheduled time.

- Each time a report finishes running, the completed version will be sent to your Report Inbox.

To automate report distribution:

- Use the “Printer Selection” function to identify the users you want to receive a scheduled report.

- Use the “Report ID” field to designate the report you want them to receive, such as a monthly cash flow statement.

- Use the “Email Printer” function to assign email addresses to printer IDs and send the recurring report to your selected users’ email inboxes along with their Business Central Report Inboxes.

Automating reports in Business Central gives you access to accurate insights as often as you need them. This feature informs your medium- and long-term strategic objectives and helps you maintain short-term tactical agility.

For example, if you detect a sharp increase in sales when comparing cash flow statements for the months before and after launching a new marketing campaign, you might consider increasing that campaign’s budget. You can receive real-time, reliable, actionable data and adapt your sales and marketing tactics in response.

Integration for Enhanced Reporting

Microsoft’s financial reporting technology in Business Central is even more potent when integrated with other applications.

Business Central has been developed to integrate third-party and native Microsoft applications. You can integrate Business Central with tools you use for the following:

- CRM

- Warehouse management

- Project management

- Human resources

- Business intelligence

These integrations make it easy to organize, access, and share accurate, up-to-date information about every aspect of your business.

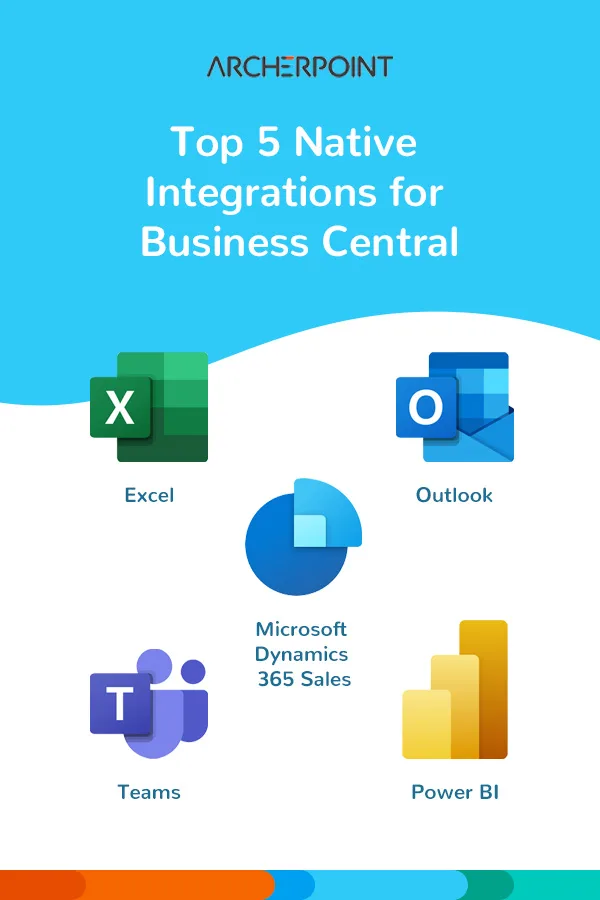

Top 5 Native Integrations for Business Central

Business Central’s integrative possibilities and the advantages these generate are endless. However, the software is optimized for integration with Microsoft’s technology stack and productivity tools. Here are four highlights of the native integrations that are possible with Business Central and their main benefits:

- Excel: View and edit information from Business Central in Excel. Use Excel to capture data about customers, sales, budgets, and invoices and to perform calculations. Publish updated spreadsheets from Excel as reports back on Business Central.

- Outlook: View contact insights from Business Central about repeat clients when emailing them. Automatically generate AI-powered sales quotes from Business Central and send them via Outlook.

- Power BI: Power BI can create charts, graphics, and other visuals to illustrate data from Business Central. You can add these visuals to your reports and republish them on Business Central.

- Teams: Access contact details from Teams to distribute reports from Business Central. Share Business Central pages and reports on teams.

- Microsoft Dynamics 365 Sales: Access inventory data from Business Central when preparing quotes in D365 Sales. Synchronize D365 Sales accounts and customer records in Business Central. Auto-transfer sales data from D365 to Business Central to populate records and financial reports.

Partner with ArcherPoint to Harness Business Central

You need to connect with a trusted Microsoft partner to purchase and implement Business Central and leverage it for business insights.

ArcherPoint is a Microsoft Certified Solutions partner. We connect businesses like yours in North America and internationally with high-value tools like Microsoft Dynamics 365 Business Central. Our service includes:

- Installing Business Central

- Setting up the software

- Identifying and setting up optimal integrations for your business

- Ongoing 24/7 implementation support

- Installing the latest upgrades for cutting-edge functionality

When you partner with ArcherPoint to harness Business Central for your business, you unlock easier work and smarter decisions to realize your business vision. You and your team can spend more time capitalizing on valuable financial insights and less time sifting through data to identify them. You also gain access to an experienced, passionate business partner who supplies Microsoft’s state-of-the-art software and the knowledge to maximize its productive potential.

Connect with our team today to leverage Business Central for insights that drive success.

Trending Posts

Stay Informed

Choose Your Preferences

"*required" indicates required fields