How Business Central Calculates the Unit Cost on the Item Card

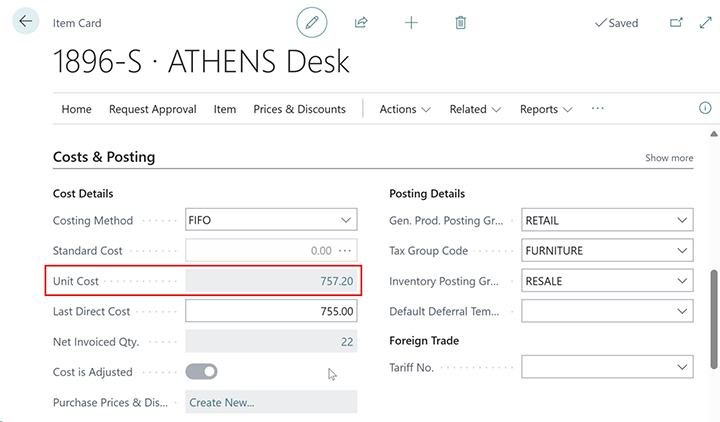

We are often asked how Microsoft Dynamics 365 Business Central calculates the Unit Cost of an item. The Unit Cost is the cost of one item in inventory. This number is critical for calculating the value of all items in inventory, establishing pricing, and determining profitability. Calculating the Unit Cost includes the price paid to purchase or produce the item, overhead, and the cost of items already in inventory.

Calculating the Unit Cost

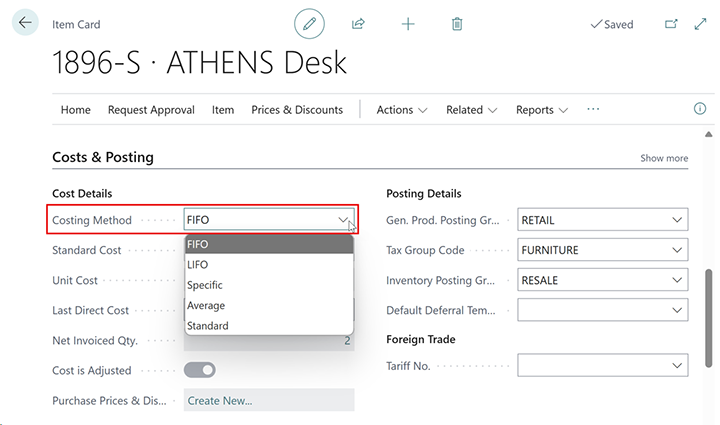

The Costing Method used by the organization (FIFO, LIFO, Average, or Specific) has a significant impact on how Business Central calculates the Unit Cost. In general, the Unit Cost represented on the Item Card is the weighted average of the cost of the items remaining in inventory.

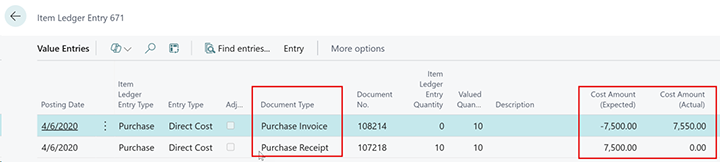

When an inventory transaction takes place, Business Central will automatically create an Item Ledger Entry and an associated Value Entry.

The Value Entry represents the cost of the transaction. Other Value Entry records may be added later using an Item Charge, inventory revaluation, or adjust cost program.

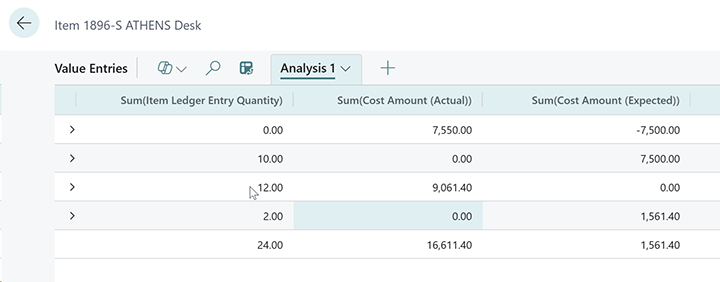

Business Central calculates the Unit Cost by using the Value Entries for the item and then adding the invoiced and expected costs (Cost Amount (Actual) and Cost Amount (Expected)) to calculate the total cost of items in inventory. Then, it divides the inventory on hand (taken from the Item Ledger Entry Quantity) into the total cost to derive the Unit Cost. Note that if an Item’s Quantity on Hand is negative, the Unit Cost is not reliable because there are no positive transactions on which to calculate the Unit Cost.

Business Central automatically updates the Unit Cost as items are sold or moved out of inventory.

In this example, a Purchase Order is received for $7,500 to the Cost Amount (Expected) column which acts an accrual. When the order is invoiced, the accrued amount is reversed and the invoiced amount, $7,550, is moved to the Cost Amount (Actual) column. Note that to post accruals, the Expected Cost Posting field on the Inventory Setup must be turned on.

This pivot table shows the Total Quantity, Cost Amount (Actual), and Cost Amount (Expected). The Unit Cost on the Item Card is calculated as:

Unit Cost = (Cost Amount (Actual) + Cost Amount (Expected)) / Quantity

Unit Cost = ($16,611.40 + $1,561.40) / 24 = $757.20

Understanding the impact of how Unit Cost determines inventory valuation is a key element in maintaining accurate inventory and financial reporting.

Find out more

If you would like to discuss this or any other Dynamics 365 Business Central costing or inventory valuation topics, please contact ArcherPoint.

If you enjoyed this blog, you might like to check out our collection of Development Blogs as well as our “How To” blogs for practical advice on using Business Central.

Trending Posts

Stay Informed

Choose Your Preferences

"*required" indicates required fields