Using Purchase Return Orders and Credit Memos in Dynamics NAV

When should you use a Purchase Return Order or Credit Memo in Microsoft Dynamics NAV? It can be confusing;

- Both end up creating a credit memo,

- Both subtract inventory from stock and create an item ledger entry,

- Both allow you to set the “Applies To Item Entry,” and

- Both allow you to use the “Get Posted Documents to Reverse”

The answer is…there isn’t necessarily a correct answer! It really depends on your operating environment and how you want to use the system.

The information below gives some guidance on when one option makes more sense than the other.

Warehousing

If you are using warehousing, you will want to use Purchase Return Orders. This will allow you to use the normal warehouse tools to ship the items back to the vendor. The Credit Memo does not allow you to create warehouse documents from it. The only way to maintain inventory integrity is to create the Purchase Return Order and create the warehouse documents so the goods ship using normal warehouse processes.

Inventory is not returned

There are occasions when the vendor agrees to issue a credit memo but does not want the product back. Many companies will accept the vendor’s authorization to discard the product and will use the Credit Memo to relieve inventory and record the credit memo to the vendor’s payable account. Normally when this is done, operations will transfer the defective material to a “Defective” location and wait for the accounting department to confirm the credit memo has been processed before discarding the goods.

Differentiating transactions

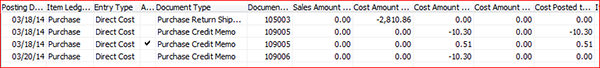

One reason to use both the Credit Memo and the Purchase Return Order is to differentiate between accounting-initiated transactions and operations-initiated transactions. The value entries are stamped with the “Document Type” that posted the entry.

Figure 1 – Here, Document Type in the value entry shows Credit Memo or Purchase Return Order to indicate whether the transaction was initiated by Accounting or Operations

Using the two different methods helps identify what was done if there are rules associated with using the Purchase Return Order versus the Credit Memo.

General recommendation

From an operations perspective, if materials are being shipped, then I would use the Purchase Return Order option. It allows you to:

- Create the warehouse documents,

- Provides the visibility of items that have been shipped to the vendor but have not yet had the credit memo processed, and

- Helps identify the difference between goods that were actually returned to the vendor versus parts that were discarded for credit.

Use the Credit Memo when the vendor does not want the goods returned to them. In this case, it is an internal control to make sure that the goods aren’t discarded until the credit memo has been processed. That is within the control of the facility and does not need accrual activity to be performed.

If you have any further questions regarding Credit Memos and Purchase Return Orders, contact ArcherPoint.